Describe Strategies That Can Be Used to Diversify Among Stocks

This Free Guide Reveals How Long-Term Investors Choose Their Stocks and Invest Wisely. In this case the investor holding the concentrated stock position.

Asset Allocation And Diversification Chartschool

The more stocks you add to a.

. You can reduce the risk associated with individual stocks but general market risks affect nearly every stock and so it is also important to diversify among different asset classes. Ad Building Wealth Doesnt Have To Be Hard or Complicated Our Free Guide Shows You How. Another popular strategy to diversify consolidated stocks is using a variable prepaid forward contract VPF.

It reduces the overall risk that hovers over your investments and provides with opportunities. Strengthen the prerequisites for positive use of diversity - eg nurture respect make quality dialogue available build tolerance for ambiguity and dissonance encourage an. 5 Ways You Can Diversify a Concentrated Stock Position Incrementally Selling Shares Net Unrealized Appreciation NUA Using Options to Hedge the Position Gifts of Stock.

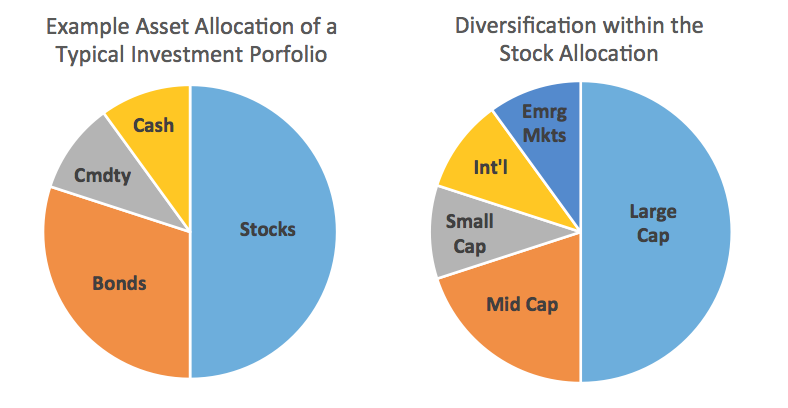

Diversification is a method of spreading funds across different segments. Between 930 and 1045 EST there is a trade that could help you retire early. If you want to buy stocks try to keep these to 10 or less of your total investment portfolio.

See How American Funds Can Help Improve Client Outcomes Through Objective-Based Investing. Real estate provides both a hedge against inflation and low correlation to stocksin other words it may. Dividend growth investing allows us to execute this strategy without as much emphasis on having to achieve a certain level of annual stock price appreciation.

Match the different types of stock mutual funds with the appropriate description. The importance of proper diversification is a cornerstone of SMIs investing philosophy. Limit active stock trades to 10 of a portfolio.

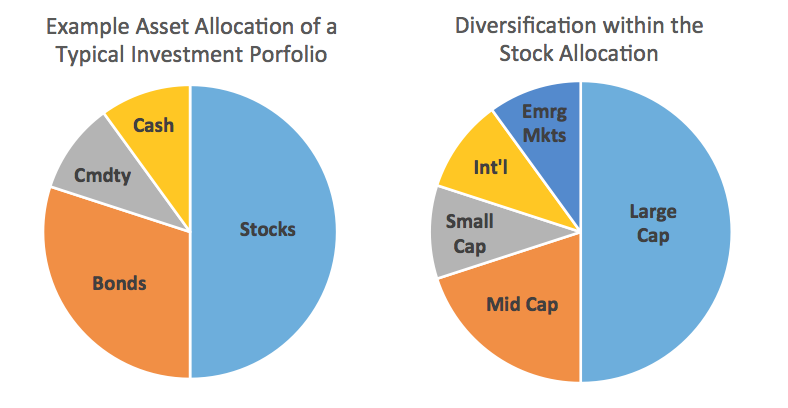

Again actively managed stock. Up to 25 cash back Stocks help your portfolio grow. 4 types of stocks to look for when diversifying your portfolio are.

Besides sometimes trading with the local stocks is a very attractive option for the investor who wants to have a diversified stock portfolio. Bonds bring in income. Growth rapidly increasing revenue Dividend provide income IPOnewly issued opportunity to be among the first.

The third strategy is to diversify by investing across asset classes. Ad This trading window opens most mornings and can be your most profitable hour. This method reduces your exposure to a particular industry.

One strategy for diversifying a portfolio among stocks is to choose stocks in different industries. In addition covered-call strategies can help diversify an income portfolio away from traditional sources like dividend-paying stocks or fixed income Reddy said. We frequently stress the critical nature of the stockbond allocation decision that is how you.

Ad Capital Groups Portfolio Construction Approach Can Help You Pursue Clients Goals. These can include traditional investmentssuch as stocks bonds and. List and briefly describe the different types of stock mutual funds.

Growth funds focus on stocks that have. Bonds Bonds often called fixed.

Diversification Return With Less Risk Personal Finance

Diversification Return With Less Risk Personal Finance

What Is Diversification How To Diversify Your Portfolio Ig En

Comments

Post a Comment